Constellation Software, Lifco, TransDigm, Lagercrantz, VMS, Decentralization 101

Musings on Serial Acquirers #1🎉

Decentralizing the M&A decision? 🤔

As many of you know, I recently wrote an updated version of my essay on Sidecar investing, with the following TLDR:

What if you could partner with a group of world-class capital allocators, sticking to a proven M&A playbook in private markets and sidecar their compounding trajectory of high-return investments? Private equity? No, these publicly listed companies have permanent capital, liquidity, diversification, and zero fees.

What I’m referring to, more specifically, are high-performing conglomerates, possessing investing superpowers at the helm, running decentralized operations in fragmented end-markets, and allowing for organic and inorganic growth via multiple small private investments. These are diversified and self-funded entities. Hence acquisitive growth is more akin to organic growth and is not reliant on capital markets. More importantly, these capital allocators should be equally celebrated for their internally diversified operations and earnings streams, not only for their compounding superpowers.

I also wrote about the importance of scaling the M&A machinery, delaying diminishing returns from size. I made it sound easy and practical to decentralize lead generation and the investment decision itself. I think this needs clarification. Most of us are familiar with how Constellation Software (disc: long) decentralizes investment decisions to one of their six operating groups and even further down to the underlying business units. Similarly, it`s tempting to think that every serial acquirer should implement this framework. After all, to a man with a hammer, everything looks like a nail. However, there is a big difference between Diploma or a Lifco and Constellation Software. A specialist acquirer buying smaller-sized businesses within the same niche can more easily push the investment decision to the underlying units. However, a generalist acquirer, on the other hand, may push down the decision to do add-ons. Still, the investment decision to go into new niches has to be made at the HQ level. Generalists and theme-based specialists benefit by operating as return-focused investors in multiple niches allowing flexibility in terms of where risk/reward is most compelling but may lose out on specialization.

Brokered vs. internally sourced deals 🤔

After watching interviews with Johan Steene (CEO Teqnion) and Robin Boheman (CEO Instalco), I started thinking about how we, as public investors, often expect multiples to be the gravitational reference point in every deal negotiation. Most earning calls has at least 2-3 questions on deal multiples, sometimes rightfully so. But the multiple is remote when the buyer is nurturing relationships directly with a potential seller over many years. The seller is not necessarily rooted in the world of M&A and is often fixated on a specific price loosely anchored on whatever price his peers got in a transaction recently, without any reference to multiples or a valuation framework. This differs in niche and market, so I`m referring more to businesses off the beaten path, not your typical VMS business receiving 5-10 calls per month. Comparing implied deal multiples on smaller private transactions vs. click-and-buy public transactions should also factor in a hefty size/illiquidity discount; after all, these are smaller-sized businesses often dependent on a few individuals and a limited number of customers and suppliers. Moreover, scale and reputation can also attract lower prices, typically achieved when deals are sourced internally over time. The seller wants to stay post-acquisition, becoming part of a bigger group not fixated on strict budget goals or an exit.

Keeping this in mind makes one appreciate the serial acquirers with an established reputation and in-house sourcing capabilities built up over many years. Not being overly reliant on brokers and fishing where the fish are eventually plays into returns on capital and long-term organic deal cadence. There is also a cold-start problem for smaller-sized acquirers that are sub-scale in terms of being able to source enough deals on their own, relying on brokers instead in the beginning (but sales growth comes easier, obviously).

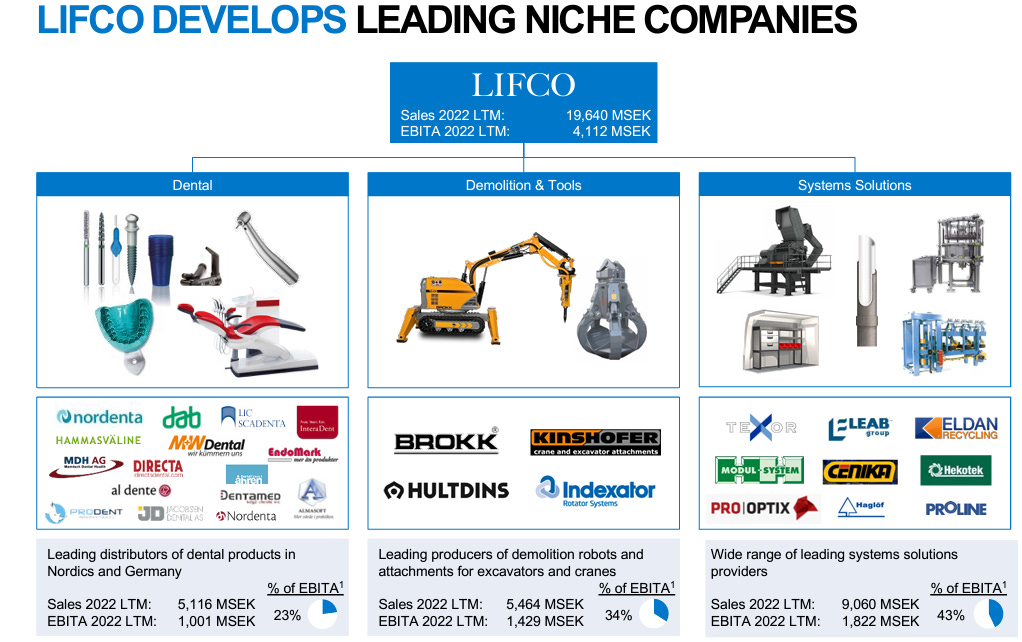

Lifco - A smörgåsbord of odds & ends

Great to see Lifco (disc: long), approaching sales of 20 billion SEK (LTM), still laser-focused on margins and returns on capital. Lifco has >6,200 employees with only ten people at the top including group managers (no central resources), running decentralized operations across ~200 underlying companies across multiple end-markets and geographies. I believe there are still only 3 or 4 people working full-time with M&A (not locally at HQ), with additional support from the management team at HQ, counting four people, including Per Waldemarson. More focus and resources are being put in place to find and evaluate more acquisitions and share the responsibility of already acquired companies among more people, including existing portfolio managers, gradually becoming more engaged in acquisitions, not only operations.

Recently I stumbled on a Swedish presentation held by Per Waldemarson back in May 2020, partly talking about scaling the organization for M&A; some highlights were loosely translated by me and may contain errors.

On targeting bigger transactions (>100-200m SEK sales):

I wish we could buy one big company every year at 6x EV/EBITA, but we`re not getting the same quality at the same price when you start going up in size [Editor’s Note: he later added that doing more deals instead of one big every year also lowers risk]. The worst thing we can do is go up in size and lower the quality.

On increasing M&A capacity to take care of more companies:

Instead of having 8-9 group managers, maybe we need 12 group managers in the future to do 50% more. [Editor’s Note: not necessarily 50% more deals but doing more in terms of taking care of existing companies, nurturing leads, etc.]

On lead generation:

We are still very much centralized when it comes to the investment decision itself, but lead generation is more decentralized. Three people are working full-time on M&A processes (outside of HQ), together with Per Waldemarson and some of his colleagues at HQ acting as “paranoid investigators” to avoid errors [Editor’s Note: keep in mind that this was from May 2020]

On avoiding mistakes:

We are internally more focused on avoiding mistakes (acquisitions) instead of hitting home runs. [Editor’s Note: Management resources spent on fixing mistakes are often more costly compared to the actual financial loss]

Question on whether they internally choose to compete within and between the groups to sharpen the competitive spirits among the various business units:

More focus on autonomy and ownership instead of a top-down approach with targeting and strict budgeting that often limits the entrepreneurial spirit

Also, Markus Olsson wrote a good intro on Lifco here.

Trust-But-Verify: Decentralization 101

We`re all trying to find the perfect but rare combination of management teams that simultaneously possess excellent capital allocation skills and are excellent operators. It`s a high bar since most great operators are not necessarily great investors. That`s why it`s fascinating to reflect on serial acquirers where capital allocation is centralized, operations are decentralized, where you have all these great underlying, often niched businesses, with motivated entrepreneurs acting like real owners. Collectively spitting out a diverse collection of earnings streams feeding the reinvestment engine at the top. This may sound easy, but the examples of high-performing decentralized acquirers are far and few between. Studying the great ones who managed to escape the base rates could reveal some engaging lessons to absorb.

The 50X Podcast with William Thorndike has a great series on Transdigm with founder and long-time CEO Nick Howley, pointing out the various trade-offs involved in aiming for entrepreneurial spirit and ownership versus “sacrificing apparent cost savings”:

I would say the decentralization was almost a religious belief for Doug and I. We both felt very strongly that if you want people to act like owners, you have to treat them like owners and pay them like owners and give them a fair amount of autonomy. That was just a very strong belief the two of us had. We had also had experience in different large organizations.

One, you have to believe it because you have to pass up at times apparent cost savings on the belief that the loss of entrepreneurial spirit and ownership will more than overcome what you might save by having a common account receivable department or something like that, or a common sales force. You just have to believe that. You'll do a lot better if you lived it for a while and had to deal in a corporate environment, where it just stifled people like that. The other thing you got to do is you got to get rid of people fast that don't fit. Everyone says they want to be autonomous and run a decentralized business. Fact of the matter is what they really mean is they want to be responsible when things are going well, but not responsible when things are... “I'm president of the good stuff.” No, you're president of all the stuff. You got to be quick to fire when somebody doesn't fit in culturally.

And similarly, in an investor dialogue hosted by In Practice on Judges Scientific, one of the analysts mentioned something similar Mark Leonard had said in response to a question on the same topic:

At some point, the law of large numbers starts working against them. I would say that Constellation is probably one in a million. I've owned it for a few years, but to me, at this point, I'm not going to lie, I'm getting a little concerned. They talk about decentralization and I remember one of the big deals with Mark. When they used to do the breakfast, somebody asked him, why don't you centralize some of these functions? Don't you think it would make sense to centralize purchasing? He said, no; I don't believe in that at all. In fact, the opposite. He said, what you might gain in efficiencies, you lose in entrepreneurship and ownership. I believe in that and I've seen it work, but it's one thing when it's a $400 million market cap company with however many people, but when it gets to the Constellation size and they are trying to do 100 acquisitions in a year, it makes me nervous. There is nobody I have seen who has been able to pull it off, other than Constellation.

Lagercrantz: Scaling the M&A machine

I tweeted about Lagercrantz recently (disc: long); the PcP Corp deal they did is the biggest one yet, and there`s more risk with bigger transactions, even in a decentralized structure without integration and strict synergy targets, but let`s see how it plays out. It`s also interesting to see how well the underlying subsidiaries are navigating the current climate despite cost increases and component shortages.

CEO Jörgen Wigh talked about their goals during the Q1-22/23 call:

The annual -- and we put up some financial goals then. The EBITA should grow more than 15% per year and at least 1/3 of that should grow organically, and the rest to 5 to 8 acquisitions per year. And we should do this in a very profitable way with having a return on equity of more than 25%. So that was a clarification regarding our goals.

Wigh also addressed bigger-sized transactions during the Q1-21/22 presentation last year:

So you've completed 2 relatively large acquisitions recently in CW Lundberg and Libra. And you mentioned that they are slightly bigger than what you normally do again. And I'm wondering, if you shifted your focus on what -- towards larger platform acquisitions and for the larger acquisitions somewhat common in the future?

Jörgen Wigh: Yes. I think the simple answer to that is yes, somewhat. I think that we would try to do both. I think we will move up a little bit, but we will still sort of make a lot of acquisitions. So the 5 to 8 is still the relevant number. But to some extent, I think we will look for some bigger ones as well. I mean both CW Lundberg and Libra are a little bit bigger than we have been doing. But it's not -- it's not like it's a huge difference. So its -- but we're moving up the scale to some extent, yes.

Rolling up VMS

In Practice shared some interesting observations on rolling up highly-engineered industrial products, similar to Halma and Judged Scientific, with Constellation Software in Vertical Market Software (from May 2022):

JDG's opcos have long R&D cycles and sell systems that last decades. If the original management team leaves post-acquisition, which is typically the case, significant technical knowledge is lost and the ROI of future R&D spend could be challenged. This could be one reason why Armfield and Scientifica struggled; when a JDG or HLMA opco goes wrong, it's near-impossible to fix without the original management team's expertise.

In VMS, arguably there is less end-market specific technical knowledge required and a more frequent customer relationship drives a greater opportunity to improve organic growth. A stable stream of recurring maintenance revenue offers the opportunity to consistently push more features and add more value to customers. This lends itself to more programmatic acquisition-led growth and potentially reduces the terminal value risk relative to one-off sales of mechanical engineering products.

There is no doubt that both JDG and HLMA are run by incredible capital allocators and in aggregate own a unique asset. It just seems to us that VMS is a superior category to roll up over any other industrial product (maybe excluding TDG's sole-source parts but we will leave that to another write-up!). Especially when CSU can pay similar 6x EBIT numbers and the holding companies are trading at similar ~30x FCF multiples.

Röko: Simple but not easy 🪄

My first introduction to Fredrik Karlsson, CEO of Röko, was during an investor seminar in Copenhagen in 2016 when he was CEO of Lifco. This fascinating duo of Karlsson and his CFO Per Waldermarson (now CEO of Lifco) presented for a small audience. Every question was coherently answered in a way that led to returns on capital and cash flow generation. Moreover, questions intended for short-term model tweaks were pretty much rejected, which I liked.

Fredrik Karlsson also held a presentation at a Serial Acquirer event hosted by RedEye back in May, available here. Almost reaching a Lagercrantz on EBITA basis in only +/- 3 years 😮

Gustaf Hakansson at Acquirers.com did an excellent interview with the team of Röko. A lot of exciting stuff on the power of simplicity, decentralization, and how they differ versus Lifco, among other things.

On the Swedish industrial tradition of decentralization and what they learned from Jan Wallander (Svenska Handelsbanken), Hans Werthén (Electrolux), and Percy Barnevik (ABB):

We have a unique industrial tradition of decentralization that is hard for us Swedes to apprehend.

These business leaders have shown that conglomerates can lead to higher performance as long as you have a simple profit goal, decentralization, and provide employees with trust.

Henry Singleton at Teledyne is also a role model. You can translate the Teledyne story and get Lifco - multiples and all. The stories are more or less identical.

The comical thing is that when we are now making ourselves IPO-ready, Nasdaq requires twice the amount of papers that they did in 2014. They are heading in the wrong direction. Business plans and budgets are considered something good. They are leaving simplicity for bureaucracy and complexity.

On minorities:

The companies we bought in my later years at Lifco that had minorities performed very well. It has worked. And at Röko, we have chosen to focus on that model exclusively.

That sets us apart from other serial acquirers. Why? Because our old traditional companies have more or less been acquired in Scandinavia. So one needs to buy younger companies that have not had the time to grow as much, and then the management needs to stay involved.

On simplicity:

Gustaf: What does your monthly reporting include?

Fredrik: Income statement and balance sheet. Simplicity permeates Röko's culture.

If you have a big organisation you need to make the goal easy to grasp. We only focus on increasing profits.

Which reminded me about the recent 50x Podcast on TransDigm and Nick Howlew emphasizing their core value drivers:

I was immediately and completely focused on what I'd call equity value creation. It was pretty obvious to me, and had been previously, that much of what you do in many large organizations has little to do with value creation. My question was how can you find a simple way to explain that to people and get them all focused around that? Between Doug and I, we were able to distill that down to what I think is the essence, the only thing that you can do to change the intrinsic value in one of these businesses, and this is true in most industrial businesses. You can get the price up, you can get the cost down and you can generate new business. Almost anything else is tertiary at best.

Feedback from readers is always welcome, and feel free to email me anything related that might interest others.

Disclaimer: Please do your own work; nothing here is investment advice. The author may have a position in the stocks mentioned.