Before continuing with my series on Sidecar investing in Europe, I’m going to focus on Evolution, whose ambition is to become the world-leading provider of online casino games. Instead of an A-Z on the company, I will delve into some qualitative stuff I find interesting. In part 2 I will explain EVO’s expanding distribution edge, the power of the lobby and why we could see more acquisitions like Big Time Gaming with favorable deal structures.

The TL;DR

Introduction

EVO is a B2B niche supplier which develops, produces, markets and licenses fully integrated Live Casino solutions to gaming operators around the world. The ambition is to become the world-leading provider of online casino games, including new verticals like Slots, after the recent acquisitions of NetEnt and Big Time Gaming.

The group employs about 8,700 people, most of which are dealers and hosts working across studios in Europe, and in New Jersey, Pennsylvania and soon also Michigan in the US, as well as Canada. In Live Casino, a game presenter, i.e., dealer or host, runs the game from a casino gaming table that is followed in real time via a video stream. End users, i.e., the players, make betting decisions mostly on their mobile devices (70%+).

The original pitch for the company was made back in 2006 when it was founded. Although not big gamblers at the time, the founders, Jens Von Bahr and Fredrik Österberg, found the online experience of Blackjack lacking caused by no physical dealer or host present. Their ambition was to make the most authentic casino experience and eliminate any trust issues player had with random generated games. This led to the founding of the company and as part of the pitch to investors, they made a video with one of the founders dealing the cards in a closet, with a camera in the roof filming. Internet penetration back in 2005 was lacking so they were too early, but the position was established. Playtech, EVO’s nearest competitor, was also started around the same time but they chased too many things at once. Starting in 2014, global adoption of streaming based services like Netflix picked up and Live Casino found a nice tailwind, with EVO growing topline 50%. At the time, EVO only had games like Blackjack, Baccarat, Roulette and Poker but that changed when Todd Haushalter joined the company in 2015. With a heavy land-based heritage, he saw the opportunity to really bring innovation into the live vertical, with the game show concepts he pioneered. The company was the first to stream casino games in full HD in 2016.

As a B2B supplier, EVO has customer relationships with gaming operators, who in turn do their own marketing and own the relationships with the end-users. Generally, the gaming operators are licensed in a limited number of jurisdictions while operating in a global market and allowing play from various geographic areas. EVO’s revenues consist of fixed and variable considerations from the company’s customers.

Most of the revenue derives from commission, which is calculated as a percentage of net revenues generated by the Company’s Live Casino platform. Net revenues are calculated as bets minus wins (gross gaming revenue), minus player bonuses (with a cap), and minus gaming taxes (where it applies). The Company has a broad portfolio of core games including both classic table games and new innovative casino games. Various game derivatives are also available, i.e., variations of the core games with new technical solutions and new content. EVO has production studios in Riga (Latvia), Tbilisi (Georgia), and Fort Mriehel (Malta), where most of the operations are conducted. In addition, the Company has a growing base of studios in USA and Canada as well as distribution in Southeast Asia, primarily via aggregators and not direct integrations. The Company also runs on-premise studios at land-based casinos in Belgium, Romania, the UK and Spain. The parent company of the group is located and listed in Stockholm, Sweden.

The Widening IP Moat

In terms of getting to the core of EVO’s competitive position, I think it’s important to look at EVO and its role in the ecosystem between suppliers, operators, and players. If you strip out one piece you risk losing the full context and hence the various power dynamics at play.

It all starts with the IP edge and that’s why you always hear management highlighting the importance of increasing the gap to competition. This is the foundation on which everything else grows, and which ultimately converts into most users and winner-takes-most dynamics. The reality for most casino operators is a dog-eat-dog world for customer acquisition with little differentiation to be made. Furthermore, there are usually 3 games generating the bulk of the revenues in any Live Casino operation: Roulette, Blackjack, and Baccarat. Europe is all about Roulette, the USA is all about Blackjack, and Asia is all about Baccarat. These are the moneymaking games, while Live Game Shows are mostly conversion tools, first for converting sports players and subsequent cross-selling to table games with higher margins. In a competitive landscape like Online Casino, a differentiated offer for Blackjack and Roulette is hard, and regulation (where it applies) prohibits excessive promotions to players (Responsible Gaming). It is far easier to make a differentiated offer for Live Game Shows, and that's part of the reason why every provider needs to have this lineup of games, and why "lobby density" becomes increasingly important.

So, in effect, EVO is not only free-riding on the customer growth of the operator, with no direct exposure to player wins/casino losses, but they are also lowering their customer acquisition cost (which adds favorable distribution and hence power the various feedback loops once again).

Players, on the other hand, are often disloyal to any one provider and may have up to 5 accounts swiping back and forth between casino operators in a matter of seconds. Without the proper lineup of popular games, you risk churning players, and the competition is always a swipe away. More games attracts more operators which begets more players. More players in a game begets a better casino experience for all existing players, a direct network effect. This is the lens in which to analyze incentives and expected behavior.

EVO and the API Economy

This is a fascinating overview of the third-party API economy where I added Live Casino and Sports betting:

Packy from Not Boring wrote an interesting piece on the API economy which included the following anecdote:

A woman approaches Picasso in a restaurant, asks him to sketch something on a napkin for her, and tells him that she’d be happy to pay whatever it’s worth. He obliges, scribbles something quickly, and asks for $10,000. “$10,000!?” the woman replies in shock, “But you just did that in 30 seconds!” “No,” Picasso tells the woman, “It has taken me 40 years to do that.

Similarly, EVO gained a first-mover advantage in the Live Casino vertical with a singular focus while its biggest competitor, Playtech, focused on its own platform with Slots and a broad range of games and basically Live Casino thrown in for free.

Eventually the competitive gap accelerated, and the EVO portfolio now counts 450+ in total including NetEnt/Red Tiger/BTG, each year with more releases, higher budgets and better quality compared to the competition. And this lead may accelerate going forward with probably more acquisitions in the pipeline (and new products/verticals/adjacencies on the roadmap). API integration in this way lets a casino operator leverage these compounded efforts over 14 years in a matter of weeks, depending on the configuration.

Most of the API customers in the overview are hiding it under the hood, invisible for the user to see. The B2B API provider is not building a brand with the end-user in mind (and often rightly so), e.g., the customer is not attracted to the sportsbook of William Hill because of the excellent technology delivered by Kambi, but players are actively looking for EVO’s games across operators. Social media (Twitch/YT) also plays a big role. In other words, if an operator doesn’t come equipped with a proper lineup of games, the competition is always a swipe away since there is no real lock-in. This changes the power dynamics and although EVO doesn’t own the end-user directly, they do so in-directly.

Furthermore, in a survey some years ago by one of EVO’s biggest customers, 80% of the live-casino players said they will play with EVO regardless of the brand of the casino. Another customer once reported that if they put up a game from EVO side by side with a game from one of their competitors, they will see an 10x+ increase in traffic with higher quality (longer session lengths etc.). Which explains why Pragmatic Play, sometimes offer their tables for free with a 5% rev share while EVO averages around 10-12%. Free tables and 50% lower price doesn’t help if traffic for EVO is 10x and contractual terms may specify positioning of games too similar to EVO’s original games. It also helps explain why insourcing or upselling games with higher margins (lower rev share), not necessarily will be the endgame here, although it may sound intuitive. More on this later.

A recent data-extract from the top 50 most played Live Casino games across suppliers (of which data is available), showed that EVO had 44 of the 50 most played games and sometimes a factor of 10x in terms of popularity:

What’s interesting in this example is the skewness in traffic distribution among suppliers, i.e., the 10x difference. This is what you would expect in a winner-takes-most business characterized by network effects and scale economies (bits and atoms). In my opinion, this is one of the most important KPIs to monitor along with IP density, and there are proxies out there, evotracker.live monitors a subset of William Hill’s tables which has 100 or so of the 700+ tables EVO hosts across its network.

Scale Begets Scale

EVO managed to bring internet scale to casino tables. In a land-based environment, scale is capacity constraint and hence no real leverage to be made on the dealer cost, facilities, free drinks etc. Streaming enables more players per dealer which enables leverage on fixed cost which explains the margin expansion and high returns. More players are not more expensive, although some games, e.g. Blackjack, is not 100% scalable and sometimes new markets and licenses require a physical presence, but that expansion is often financed by their customers (yes, you read it right).

Live dealer is the most expensive version of online gaming and might involve 6-7 people rotating on each table working an 8-hour shift. In the background there is a 24/7/365 live broadcast with security and operations. In other words, this is not only a full-scale Netflix operation with a live-broadcasting operation attached, but also one of the biggest physical casinos in the world (in aggregate across markets) with 8,700 people.

Of the around 700+ tables, EVO currently host across 300+ operators, 80-85% of these are dedicated (most of which are Blackjack tables), and 15-20% are generic tables (also called network tables), i.e., generic tables not custom branded for any particular operator and open for everyone across operators.

A dedicated table can amount to $20,000-50,000 in one-off setup fees with 55-60% margins on top of the rev share between ~4-17% depending on the size of the operator (traffic potential), type of games (e.g. Monopoly Live licensed from Hasbro) and other factors. The average is around 10-12%. In addition, there is a monthly fee of between $5,000 and $20,000 per month per table. Contracts usually run for three years. A tier-1 operator might have 30 dedicated tables, that could easily be EUR 1 million as a sunk cost and the facilities belongs to EVO and can be further rebranded or used as a generic table if the operator ever were to churn. This not only increases switching costs but also incentivise additional distribution into the EVO ecosystem.

Spreading IP and other fixed costs across a growing player base translate into lower unit costs per user and higher barriers for successful entry (e.g. lower break-even allows for lower rev share), higher release density at better quality than competitors as well as healthy growth economics (e.g. incremental FCF margins). No rational competitor of EVO could make a production like Crazy Time, the most expensive production to date, and justify the cost on a per user basis.

Furthermore, this explains why most competitors are burning cash on their Live Casino offering and perhaps why Playtech recently stopped disclosing their live offering on a segment basis. Existing, and especially new, competitors are all facing the cold-start problem: Without a portfolio of popular games and a physical base across jurisdictions, you can’t attract enough operators/players and hence you can’t be competitive. Internet enabled network effects only accelerate the distribution skewness and further weakens the sub-scale reality for other players.

Perhaps many of us are getting acclimatized to flywheels sketches by now and nod along, but the dynamics laid out are of utmost importance in fully internalizing the competitive dynamics at play and the future growth economics, e.g. what margins to expect going forward and what the industry structure may look like in 5-10 years.

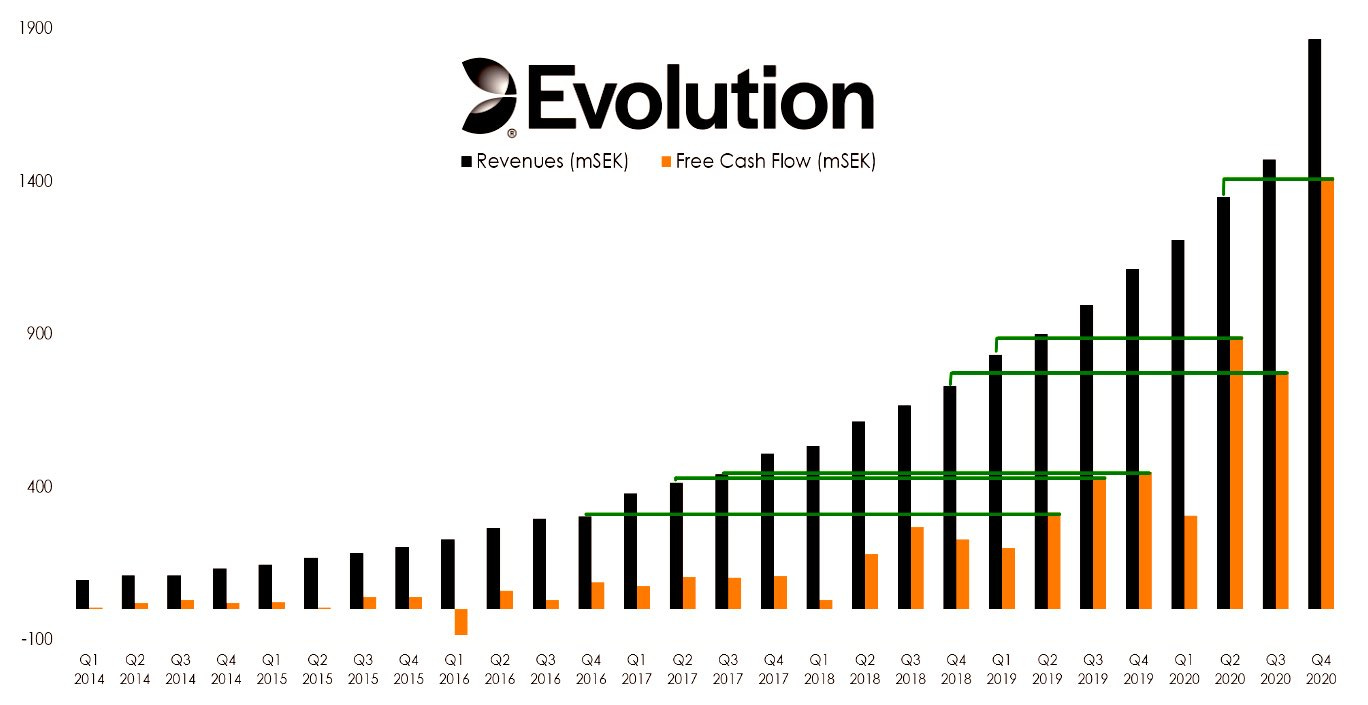

Increasing returns to scale coupled with network effects against a large TAM, enable some interesting growth economics:

In part 2 I will explain EVO’s expanding distribution edge, the power of the lobby and why we could see more acquisitions like Big Time Gaming with favorable deal structures.

Disclaimer: Please do your own work, nothing here is investment advice. The author has a position in the stock.